This blog has been created and maintained by the Town Manager to provide information to residents and respond to questions that residents may have. I will post comments or questions from residents that are relevant to all residents, but will not use the blog as a dialog with individual residents. As such I may re-phrase some questions at my discretion. Questions or areas of concern can be emailed to me at Jim Malloy. Please include your name, address and phone number in case I need to contact you to clarify your question.

Up to the date of Town Meeting, I will make it a priority to respond to questions regarding the Town budget, Town finances or Town Meeting articles but will also try to respond to other questions or comments as time permits.

Posted 12-21-15

Question: What are those "concrete tubes" around the downtown and why is the Town digging up the sidewalks downtown? It looks terrible!

Answer: The Town is in the process of installing "period-style" street lights downtown similar (but nicer) to those at the Bay State Commons. The new downtown street lights will have banner arms to allow the Town to install displays at different times of the year. The Town had to dig up the sidewalks because the electric company indicated that the existing underground conduit was installed so many years ago and they have no records of where they are situated, that they did not want us to use them. The overall plan is to replace all of the granite curbing in the Spring of 2016 as well as all of the downtown sidewalks. The first two new street lights have been installed in front of Town Hall.

Posted 12-10-15

Question: Now that the Town Hall renovation is completed, when is the Town going to re-open the alleyway next to Town Hall, this is a great short cut through to South Street. I use it all the time instead of waiting for the traffic at the Rotary.

Answer: The Town is not planning on re-opening the alley next to Town Hall. As part of the Town Hall renovation, the Town decided to close this alley to vehicle traffic and will be installing brick sidewalk similar to the sidewalk in front of the Town Hall from the Town Hall to the abutting building and will install bollards to keep traffic from the Town Hall parking lot from accessing the alley. The alley will be converted to a pedestrian access walkway and community gathering spot. The plan is to install some tables and perhaps a bike rack in the alley once the brick work is completed. The Town Hall architect is working on the bid specifications for this project so that it can be put out to bid during the winter months and be ready to go first thing in the Spring.

Posted 11-24-15

Question: I've been noticing the new electronic billboards on Route 9 have all kinds of town sponsored information and information from local non profits, school plays, the community chorus, civic club and even the Red Cross. Is the Town paying for these and if so, how much is this costing the taxpayers?

Answer: The Town signed an agreement with Clear Channel Communications that allowed the new digital billboards to be installed on Route 9. As part of this agreement, the Town is paid $10,000 per billboard "face". There are four billboards, so the Town is receiving $40,000 per year for the billboards and the agreement calls for every 9th billboard display to be a public service announcement for the Town. Clear Channel's art department has been great to work with and puts together professional billboard displays for our departments and local non-profits. Using the billboards for local Red Cross Blood Drives has really helped the success of these blood drives. Additionally, whenever there is an Amber Alert all of the billboards immediately switch to the Amber Alert information. It doesn't

cost the taxpayers anything and gives the Town an opportunity to put event announcements out where most residents will see them!

Posted 11-5-15

Question: It's nice to see the State is finally painting the E. Main Street Bridge. Why didn't the Town push to have the bridge raised so that it isn't so low?

Answer: The State did NOT paint the E. Main Street Bridge. Although this bridge is now owned by the MBTA/MA Dept of Transportation the State probably would not have done work on this bridge anytime in our life times. When the Town approved the CSX Transflo Rail Yard project (CSX used to own the bridge), the Town received a mitigation payment from CSX and set these funds aside for future projects. One of these projects was to repaint the railroad bridge in the downtown area. By next Spring, the Town will have also installed new period style street lights that will match the color on the bridge and will be installing new sidewalks to spruce up the downtown area. This is another project brought to you by the Town (not the State)!

Posted 9-17-15

Question: The Town Hall is starting to really look nice, when will it re-open?

Answer: The expected date for the Town Hall to re-open is November 10th. The furniture, files, computers, phones, etc. will be moved in the previous week and some town staff will be working over the weekend to ensure that computers and phones are operable when the staff comes in on November 9th. Town Hall will be closed on November 9th to all staff to set up their offices and will re-open on November 10th for the public. There will be a ribbon-cutting the evening of the 10th at both the Town Hall and the new Fire Station, beginning at 5 PM at the Fire Station.

Posted 8-13-15

Question: Now that the Town owns the former State Hospital property, what are the plans and when will there be public forums to allow us to have some input on how this property is redeveloped?

Answer: The Board of Selectmen established a State Hospital Re-Use Committee which is chaired by the Planning Board Chairman Brian Bush and I serve as the Vice-Chair since under the Town's Charter, the responsibiltiy for all Town-owned land falls under the Town Manager. We have been meeting for about a year and have reviewed both the report from the Planning Charrette conducted by the University of Massachusetts and the report from the Urban Land Institute. The Committee is focused on developing zoning that would result in the outcomes highlighted in those reports as those that residents sought for the redevelopment of this property. The Committee is also debating the future subdivision line of which portions of the property the Town would like to keep for current or future municipal uses and which portions of the

property would be better to put up for sale for redevelopment. There will be public hearings in November and December with the final recommendations to be provided to the Board of Selectmen in January. The recommendations will go before Town Meeting on March 12, 2016 for final approval from the voters of the Town.

Posted 7-5-15

Question: Why did the Town only pave a portion of Milk Street? The worst section is the area around the new Fire Station. It seems like poor planning to pave miles of Milk Street (from the Northborough town line) and then not finish the project!

Answer: There is several drainage improvements that are part of the parking lot project for the new Fire Station and these will cause Milk Street to be excavated in certain areas, while it may seem like poor planning, the Town is actually planning around these improvements to ensure we are not excavating in a newly paved road. These improvements will be completed by Fall 2015 and the remainder of Milk Street will be paved in the Spring of 2016.

Posted 3-20-15

Question: What's Up with the Town Hall renovation project? Has the Town decided to stop work? It's looked the same for the past several months. It's sad to see the old building just sitting there with the clock tower wrapped in plastic.

Answer: The Town Hall project has continued under construction by the contractor RAC Builders. During the winter months, the construction has mostly been on the inside with a lot of HVAC work, electrical, fire protection and new construction of offices. If you drive around back through the parking lot you'll also notice a large addition that houses the new interior fire escape (the building used to have 3 exterior rusting fire escapes). This additional also provides a air lock to keep heat and air conditioning in the building and contains accessible bathrooms on the first and second floor as well as storage. While the project is going slower than the Town would like, there is a completion date of July 21, 2015 and if the contractor doesn't have the project done by that date, the Town will pursue liquidated

damages against the contractor.

Posted 9-29-14

Question: Why does the Town use oil and gravel instead of paving roads?

Anwer: The Town has just under $800,000 per year for street maintenance and some quick facts will demonstrate why the Town uses "stone sealed" processes with oil and gravel on some sidestreets and why we don't pave every road in Town. Every year the Town undertakes a Road Management System rating, the current year's can be found here and using the first street

listed (a 0.31 mile section of Adams Street), to undertake a stone sealed process on this street would cost approximately $8,600 while paving with bituminous asphalt would cost approximately $95,000. In Westborough we find the average paved road has a life expectancy of 12 years and a stone sealed road has a life expectancy of 6 years. Given the Town's limited resources and just over 97 miles of roads to manage, the Town has to make decisions on which roads are paved (generally main thoroughfares or roads that are being reconstructed due to utility work) and those that are stone sealed (side streets). While the initial job has loose gravel for a few weeks, on the positive side, it provides better traction in the winter months!

Posted 7-23-14

Question: Do you know why the cross walk painting in front of the post office was blacked out? I bike, walk, jog up there all the time and now there is no safe place to cross. The sidewalks are on the opposite side of the street from the post office so there is no safe way to approach the PO on the side of the street that the PO is on. Was it (the blacking out of the current cross walk) part of the redesign of the sidewalk in conjunction with the new senior housing and if so will a new one (maybe form a different point along that side of the street) be added?

Answer: The crosswalk was blacked out because it didn’t meet the Federal MUTCD standards . There needs to be a sidewalk on both sides of the street for a crosswalk to be installed.

Question: What is the status with the re-painting of the RR bridge across W. Main Street? When that does happen is there any chance of getting it painted some color other than industrial battleship grey? How about Rangers red or pink in honor of breast cancer awareness? How about asking the town or polling them via the Patch or a suggestion box in the library?

Answer: If the bridge is repainted by the Town it will either be blue or black. According to the MBTA those are the easiest colors to match after graffiti. I met with the MBTA Engineering Division a few months ago and then went back and forth between them and CSX on who had any records on whether there was lead paint. After some back and forth, I did get an answer from MBTA that there was lead paint that would need to be dealt with. We then got a quote from the company that recently repainted the water tank on Newton Hill (aka the Route 9 water tank) and it was upwards of $400,000. I then spoke with the DPW Manager about whether it could just be painted over in the condition it was in just to make it look better (my thought is that if you could just paint over it for a low enough cost and you had to redo it every 5 or 10

years, it could take a long time to make up $400,000). We went out and looked at it and unfortunately it’s been let go for so long that it needs to be sand blasted, have an application of rust protection and then several coats of paint to ensure it lasts and then there’s coordinating with the train schedule and meeting safety standards, hence the high price tag (also, when sand blasting you have to capture the material since it’s lead paint). So we’re still looking at it.

Question: What is the process re: multiple cars parked on lawns? Are any laws being violated? What if anything can be done about that?

Answer: You are allowed one unregistered vehicle on a property. If there’s more than one unregistered vehicle, it’s a zoning violation that would be handled by the Building Commissioner.

Question: I have been helping the Westborough Community Land Trust with their Earth Day town wide clean-up for years and in so doing have become even more aware of how some businesses are not being good neighbors. Do the citizens of Westborough through their elected officials have any leverage to get these businesses to pick up after themselves? I imagine if I littered or kept my property in the same state of disrepair as they do and the things that were dropped on my property blew into the street, the neighbor’s yard or in the nearby wetland there would be some negative consequences.

Answer: Littering is illegal but that’s for the person that’s littering, not the company that makes the product. The only thing the Town could do would be to ask (and then follow up) with each business that may need to be targeted to see if they’ll send employees out to pick up after their customers.

Posted 7-21-14

Question: Can the Town add more sidewlaks to Ruggles Street between Chestnut and the High School?

Answer: We've reviewed this request and while there is sufficient right of way, there are wetlands and slope issues that would make this a very expensive sidewalk. However, the Town has been considering expanding the Road Management Program started in 2010 to begin including sidewalks. This would provie the opportunity for the Town to reivew the condition of existing sidewalks of which there are approximately 42 miles and plan for new sidewalks to provide interconnectivity such as this request. This will be one of the improvements in planning that will be included in the Fiscal Year 2016 budget when the budget process begins this Fall.

Posted 6-20-14

Question: What is going on with the Fire Station and Town Hall projects? When will they be finished?

Answer: The Fire Station and Town Hall projects are both well underway. The Fire Station will be finished first and is expected to be completed in late September with the Fire Department moving its operations next door to the new station. At that time, phase II will kick in and the demolition of the existing fire station will take place, with this area becoming the parking lot and landscaped area for the Fire Department. At this time, the General Contractor is beginning to do finish work on the inside, including painting ceilings, installation of doors, etc. and they have begun the floors in the apparatus bays and are finishing some of the exterior work. During the month of August residents will really see the building shape up and begin looking like a finished Fire Station!

The Town Hall is expected to be complete in May 2015. Most of the work on the Town Hall has been interior work, including demolition of the existing interior walls and reconstruction of new walls, installation of new Heating and Air Conditioning systems and plumbing. There was a slight delay to deal with the electric transformer, but that's been resolved and the rear addition which will include a new entrance, accessible bathrooms and interior fire escape (all three former exterior fire escapes have been removed) will be started in the next few weeks (the architect is working wtih the General Contractor to ensure the bricks match the existing structure as much as possible). The elevator pit has been built and soon the construction of the elevator tower will commence providing access for the second and third floors,

as most town resident know the Town has been limited to using the first floor of the building, so this will open up much more space. On the exterior side, the clock tower has been partially deconstructed and all of the woodwork on the front of the Town Hall has been removed so that the woodwork can be replicated and replaced.

The good news is that both projects are substantially below original estimates and with the Town's upgraded bond rating, debt service costs will be lower than originally projected.

Posted 2-4-14

Question: Does the Town have an official organization chart?

Answer: Yes, based on the Town Charter the following two charts (click on the charts to enlarge) show the overall organization of the Town and the departments, boards and committees reporting to the Town Manager:

Posted 1-2-14

Question: I saw a guy plowing out a driveway in the snow storm this week and he plowed it across the street, leaving snow in the road. Is this ok?

Answer: Actually it's not ok. It costs taxpayers for the Town to run plows a second time around to clean up problems like this. In this past storm, the Town spent two hours doing extra clean up from driveways being plowed across the street, at $3,000 per hour (for all the trucks) this costs taxpayers $6,000 after each storm. If you see someone doing this, please call the Public Works Department at (508) 366-3070.

Posted 3-26-13

Question: What forms of tax does the town receive direct benefit from when it comes to business? Property tax on the building is one but do we get meal tax, tax on inventory, any form of payroll tax etc.?

Answer: The Town receives a 0.75% meals tax and personal property taxes, if the business has vehicles registered in Westborough we also receive excise tax on the vehicles.

Question: When the Town says BJs “created” 1100 jobs, did they actually add 1100 jobs to their payroll or did 1100 jobs move from Natick to Westborough?

Answer: 1100 new jobs in Westborough, 1100 that left Natick...

Question: Again with respect to BJs, the 1100 jobs, how many were lost when national grid left? Is the 1100 a net number? Is there a benefit if those 1100 just go to the office to work and then leave at the end of the night and go home to Natick? (aside from possibly using the hotels for visiting workers and going out to lunch etc.)

Answer: I’m not sure how many jobs were left at the National Grid building when they left since that was before 2009 when I was hired, I have to imagine that it was somewhat similar given the size of the building. When I started in 2009 I believe there were about 10 – 20 people from National Grid working out of that building. I’m not sure where the employees at BJs or other businesses live, I assume some live locally but even for those that don’t there is evidence that they do spend their dollars here in Westborough in the form of increases in the Meals Tax that we’ve seen since it was implemented a few years ago to huge increases in our hotel room tax over the past few years as businesses (BJs and eClinical Works are two examples I know of) bring in customers, clients and staff from other regions around the nation for

meetings here. Our room tax revenues have increased from $561,000 in FY10 to a projected $944,000 in FY14 (starts July 1 of this year) and our meals tax has gone from $448,000 in FY11 (the first year it was imposed) to a projected $561,000 in FY14. While this only represents an increase of $113,000 in revenues to the Town, I believe if you do the math to figure out what the increase in actual sales at restaurants to generate that level of revenues over the three year period the increase was from $59.7 million to $74.8 million (+$15.1 M or 25%). That’s pretty impressive and great for local restaurants and is no doubt why we’ve seen several new restaurants open in the last year and another looking to locate at Bay State (maybe it will become a restaurant mecca?).

Question: When a business moves jobs to town and simply takes over an office does that add to the tax base? In other words if the property owner is already paying property tax on the building are other forms of tax created when that space goes from vacant to filled?

Answer: The way commercial property is assessed, the value is set by the rental value of the space per s.f. (that’s pretty simplified explanation, but I believe that’s a good way to characterize it). As a result, when there are a greater number of vacancies and rates drop to attract new businesses, this actually results in lower commercial values and a shift of the overall tax burden from commercial to residential. This has been the case throughout MA (except maybe Cambridge and Boston) for the past several years. Once that space fills up, as we’re experiencing, either rates will go up or new buildings will go up as rental prices increase. It’s at this point that commercial values should increase and the Town would see an increased tax base. There was a lag during this last economic downturn of a couple of years and

as the economy gets better, there is going to be a lag on the upswing as well. From what I’ve read, the duration of the lag is likely to be longer than the downturn.

Question: It would seem that if you took Fountainhead as an example, apartment complexes are a huge drain on the system and they have relatively low tax assessment. How is that accounted for and justified with the number of children in the school system many of whom use the most expensive of the services? Would a dual tax rate raise the rate paid by apartment buildings? Their assessments seem a bit out of whack considering how close to market value single family assessments are. I would think one Fountainhead building has a market value a multiple of what its assessed value is.

Answer: A dual tax rate would not raise the rate paid by apartment buildings, they would fall under the residential category. The total assessed value of Fountainhead is $33.5 million and their taxes paid per year are $635,000. Of the current tax bill, approximately 75% goes to the Schools and 25% goes to the Town services. Of the 562 units there are 223 children in the school system which works out to approximately $2,136 per child (using the 75% that goes to schools). As a comparison, the average single family home valued at $420,266 pays $7,972 and if they have 2 children it works out to approximately $2,990 per child (using the 75% of taxes that goes to schools). The difference isn’t really that great when you consider that the School budget is $41.3 million and there are 3,585 students or $11,515 per student average

cost. Neither single family or multi-family properties pay near the actual cost of educating children (using the average).

Posted 3-14-13

I don't have time to read through and understand the Town Meeting warrant and budget but plan on attending Town Meeting on Saturday. What are the hot topics and issues and can you give me your thoughts on them?

Answer: The Advisory Finance Committee's Handbook is now on the Town's homepage and it contains summary explanations from the Town Manager of each arrticle, the following are those summaries:

Article 1 - Annual Town Elections - This article is a reference only and Town Meeting doesn't vote on it.

Article 2 - Rule of the Meeting - The Town Moderator wants to try to keep the meeting on a better pace and instead of having the Boy Scouts run all over the auditorium handing out wireless microphones while the rest of the voters wait, he wants to limit this to the lower level of the auditorium and require voters sitting in the upper balcony to use the standing microphones.

Article 3 - Town Reports - This article is also for reference only.

Article 4 - FY13 Budget Transfers - This article is for making any budget transfers for the current fiscal year. We have one transfer for the Veterans Department which has handled more claims than usual and the transfer will be for $24,000 (75% of this will be reimbursed by the Commonwealth). Funds will be transferred from the Insurance budget.

Article 5 - Amending the Wage and Salary Schedule - This article covers the 34 non-union employees and amends their wage schedule. Westborough has traditionally used the average of the union contracts from the previous year. For the upcoming Fiscal Year, this average is 1.6%. Each year we also compare this figure to the Consumer Price Index (Inflation Rate) for our area and for the last year this also was 1.6%. Therefore the wage schedule is proposed to be increased by 1.6%.

Article 6 - FY14 Operating Budget - The budget covers the operating costs of all town departments and the school department in the General Fund as well as the Sewer Fund, Wastewater Treatment Fund, Water Fund and Country Club Fund. The total increase in the General Fund budget is $1,902,612 (2.5%); the major increases are School Department $1,356,562; Insurance $174,800; Police Dept $106,486; Fire Dept $88,908; DPW $51,699; Library $69,289; and Veterans Services $35,210. The Sewer Fund is budgeted to increase $8,519; Wastewater Treatment Plant to be reduced by $191,178; Water Fund to be reduced by $191,234; and the Country Club to be reduced by $29,460. Overall for all funds, the Town's budget is projected to increase by $1,499,259 or 1.7%.

Article 7 - Regularly Recurring Articles - This article covers 8 different items that come up every year including revolving funds, reserve funds, Ch. 90, etc and are put into one article as they are annual items that are the same every year.

Article 8 - Capital Improvement Plan - The Town uses a priority based rating system in which department heads submit requests that are then rated by a Committee using the following criteria: Public Safety and Health, Infrastructure Needs, Efficiency of Services, Legal Requirements, Public Support, Personnel Impact, Service Impact, and Administrative Needs. Each one of these criteria are rated on a scale of 1-5 and then the requests are sorted on projections of what the Town can afford over the next five years. Those projects not rated high enough to be funded during the five year planning period are taken off the list. The Town uses free cash reserves to fund one time capital expenses.

Article 9 - Town Hall Renovations - This is the same project that came before Town Meeting a year ago, on the Town Manager's webpage and Building Projects Update there are additional links related to this project. The project cost has been adjusted to account for inflation during the past year and to provide $200,000 for temporary relocation of the Town Hall during the renovation. As the information on the Building Projects Update link on the homepage show, the project can be done without impacting the tax rate as the debt service for this project will be replacing existing debt service that is being retired.

Article 10 - Forbes Roof Repairs - The Town previously had appropriated $330,000 for the replacement of the roof at the Forbes Municipal Building but held off while planning a complete renovation. During a storm this past Fall, a portion of the coping around the roof was ripped off and exposed an area of rotted decking. The Town engaged the architect working on the Town Hall project to look into this and provide an estimate for repairs which has been done and the plan now is to make these repairs and replace the roof since the Building Projects are being done in a phased in manner and this building project will not be taken up for a few years.

Article 11 - Installation of High Visibility Crosswalks - This article would provide funding to install recessed reflectors (so they're not damaged by plows) in crosswalks around Town and to install high visibility signage at the crosswalks.

Article 12 - Town Water System Improvements - This article would fund cleaning of water lines around Town to reduce the dirty water issues that have occured in the last two years and to review processes at the Water Treatment Plant.

Article 13 - CSX Mitigation Account Appropriation - When CSX moved part of their operations to Westborough and went through site plan review, CSX was required to fund certain mitigation at the amount of $1 million. The MA Dept of Revenue has issued an opinion that Town Meeting needs to approve the appropriation prior to the Town making expenditures from the account. The mitigation involves the railroad and the impacts around town including hazmat, paving the road where the new CSX facility is and making improvements around the E. Main Street railroad bridge, including an electronic height sensor and potentially repainting the bridge.

Article 14 - Assabet Vocational Reserve Fund - This article would authorize Assabet Regional Vocational High School to establish an account to set aside funds to pay accrued vacation and other leave when employees retire. There is no appropriation associated with this vote.

Article 15 - Youth Commission Membership - This article would expand the Youth Commission membership from 5 to 9 members with the 4 new members being high school students.

Article 16 - Zoning Amendment Relative to Medical Marijuana, Treatment, Dispensing and Cultivation Facilities - This article would allow these facilities only by special permit and only in the Adult Use District.

Article 17 - Citizen's Petition - This article seeks to hold the tax rate to a 0% increases over the next two fiscal years (FY15 and FY16).

I wouldn't call them "hot topics" but the Articles likely to have debate will be Article 6 (Annual Budget); Article 9 (Town Hall Renovation); Article 16 (Medical Marijuana); and Article 17 (Citizen Petition).

My thoughts on these Articles are -

Article 6 - The Board of Selectmen set a goal of limiting the overall tax increase to 2.0% and to not include new growth as part of the tax base for FY14. The budget as presented exceeds this goal coming in with a 1.7% increase overall. This is due to departments holding the line on budgets, several large decreases to offset any increases and an effort to keep health insurance costs as level as possible in FY14 (overall insurance is up 1.7%). Based on meeting these goals and keeping costs to a minimum I would ask voters to support the budget as presented.

Article 9 - Last year when first presented as part of a package of five building projects (Fire Station, Town Hall, Gibbons Middle School, Forbes Municipal Building and a new Recreation Center) the Town Meeting voted to fund only the design of the Town Hall and Forbes (Gibbons was voted at a separate meeting to hire an Owners Project Manager and the Fire Station was approved at last Fall's Town Meeting). Since last year's meeting, we have separated out the projects and proposed to fund them in a phased in manner over the next several years so that the debt costs associated with these projects is offset by retiring debt. The Selectmen set a goal of keeping debt service at no more than 7% of the General Fund Operating Budget; that debt service is maintained at or less than the FY12 Debt Service Budget of $5.5 million and to

undertake all projects under the Proposition 2 1/2 levy limit. The Fire Station and Town Hall projects were the first two scheduled on the phased in plan and this Article is consistent with this plan. Unfortunately, due to an approving economy, this project will cost approximately $500,000 more now than when it was initially proposed a year ago. The Town has looked at options such as moving out and selling the Town Hall and leasing office space but after a public hearing on this proposal, it was clear residents preferred that the Town Hall be renovated. As this is part of an overall plan that keeps the impact to residents at a minimum and the work needs to be done I would ask voters to support this project as presented.

Article 16 - This is the Planning Board's Article and it seeks to limit the medicinal marijuana dispenseries and cultivation to the adult use zoning district, this seems to be both a reasonable and rational approach and would recommend that voters support this Article.

Article 17 - This petitioned warrant article asks voters to maintain the tax rate at the same rate for FY15 and FY16 that it is in FY14 (the upcoming year we're voting on at this Saturday's Town Meeting). There are several issues with this article. First, a vote of a Town Meeting cannot bind future Town Meetings, so the article has no legal effect. Second, it seeks to hold the tax rate, not total taxes to a 0% and at the time we vote on budget expenditures we don't know what the "tax rate" is and the proper way to maintain the tax rate is to through the setting of expenditures. Third, the Town has been taking steps to control taxes and this has been reflected in the Town's Excess Levy Capacity Growth (the taxes we could levy but don't) of 4532% (yes, that's right) from $95,000 five years ago to an

estimated $4.4 million in FY14. While the goal is understandable (everybody would like to pay less taxes) the Town has already worked on controlling the taxes. I believe this Article is unnecessary and doesn't achieve anything that legally binds future Town Meetings and therefore recommend that voters vote against this Article.

Posted 3-13-13

Why is the Town out plowing at night time when you knew it was going to be 50 degrees. Isn't this a waste of taxpayer dollars?

Answer: Sometimes the Town has to undertake projects that may not otherwise make sense to a resident and I can’t imagine there are residents familiar in Town with the specific court decision that requires the Town to clear sidewalks.

As of this morning, there is still snow on sidewalks on some side streets in Town so the 50 degree weather did not melt the snow where it had been plowed off of the streets and onto sidewalks. The reason this is an issue is that the Town owns the sidewalks and under a court decision from 2010 (Papadoupolus vs. Target), the MA Supreme Judicial Court (SJC) determined property owners have responsibility for both natural and unnatural (unnatural being where it’s been plowed) accumulations of snow. For cities and towns, this meant that where we once had very limited liability that we now have a much greater liability in relation to “slip and fall” accidents on and around sidewalks.

Two years ago, after this SJC decision I attempted to have a bylaw passed at Town Meeting that would require abutting property owners to clear sidewalks to help reduce the Town’s liability (it didn’t pass at Town Meeting, despite the fact that the Town had previously had such a bylaw and had removed it from the bylaws at a previous Town Meeting). In congested downtown areas where the Town “invites” people to be walking by adopting zoning that allows businesses to exist and with the installation of sidewalks we have a much greater liability that again requires us to do things in a manner that might not otherwise make sense to residents.

So while this may not make sense to all residents given the weather, leaving the snow downtown on the sidewalks for a few extra days created a liability for the Town, therefore we removed as much snow as possible.

Posted 2-5-13

Why does the Town put flouride in the water system, shouldn't residents have the opportunity to vote on this?

Answer: The Town follows the recommendations of the medical and dental community on the benefits of flouridation of the Town's municipal drinking water. This includes the American Dental Association (ADA), American Medical Association (AMA), American Academy of Family Physicians, American Academy of Pediatric Dentistry, American Academy of Pediatrics, the US Centers for Disease Control and Prevention among others. The addition of the flouride in the drinking water is a decision the Town makes as a matter of operation of the water system, it is not something that would go before voters. Notwithstanding this, residents could petition seeking a Town Meeting vote on the matter.

Posted 1-31-13

What's coming up on the Annual Town Meeting warrant?

Answer: The following is a summary by Article on the Annual Town Meeting warrant. There are 17 Articles and the warrant is 17 pages long. Town Meeting is on March 16th at 1 PM at Westborough High School.

Article 1 - Annual Town Elections - This Article is repeated every year and is related to the Town elections that occur before Town Meeting.

Article 2 - Rule of the Meeting - The Town Moderator submitted this warrant article to require to have the voters in the second row and beyond in the balcony come down to the standing microphones instead of using the portable microphone to see if this helps Town Meeting move along a little quicker.

Article 3 - Town Reports - This Article is repeated every year and is just to hear the Town Reports of the various Town Offices. The Town Reports are provided in writing in a separate Annual Town Report available before Town Meeting.

Article 4 - FY13 Budget Transfers - This Article is a placeholder for any current year budget transfers that are necessary. This year the only transfer that is known will be for the Veterans Department as we have more clients receiving benefits. 75% of the cost of the benefits are reimbursed by the Commonwealth.

Article 5 - Amend the Salary and Wage Schedule - This is for the approximately 25 non-union staff of the Town to amend the wage scale by 1.6%. This figure is historically based on the average of all of the union wage increases for the previous year.

Article 6 - FY14 Operating Budgets - This Article contains the Salaries and Expenses for all Town Departments, including the School. The budget is proposed to increase by $1,941,459 (2.5%). Of this increase, the major increases (over $50,000) are: $1,426,136 is related to the School Department; $174,800 is related to Insurance; $106,486 to the Police Department; $88,908 to the Fire Department; $69,289 for the Library (this has to do with no longer applying the State Grant and Trust Funds to their budget); and $51,699 for the DPW. The good news is the Wastewater Treatment Plant budget is going down by $191,178 and we're working on getting a loan on the recent upgrade refinanced from 2.0% to 0.0% which will decrease the figure further and the Water Department budget is going down by $191,234.

Article 7 - Regular Recurring Articles - This Article is for those items that show up every year and are as follows:

A. For the Fire Department we have a Revolving Fund that allows the Fire Department to charge fees to cover the expense of provided CPR and First Aid Training in the community as a self-supporting program.

B. For the Youth and Family Services Department we have a Revolving Fund that allows the department to charge for youth activities in order to cover the cost of those youth activities. This includes the "Hot Summer Nights" program and babysitter training among other programs.

C. For the Board of Assessors we have a recurring article that accepts the provisions of the state law increasing property tax exemptions for various reasons (elderly, blind, veterans, etc.) at an amount 100% of statutory amount. For example, if the statutory amount is $500 in Westborough it would be $1,000.

D. For the Advisory Finance Committee the Town sets aside $300,000 in the General Fund; $50,000 in the Sewer Fund; $50,000 in the Water Fund; and $20,000 in the Country Club Fund as a Reserve Fund to cover any extraordinary and unforeseen expenses.

E. For the Recreation Committee the Town sets aside $2,500 for the July 4th Celebration.

F. For the Local Emergency Planning Committee the Town establishes a Revolving Fund to cover the cost of hazardous materials release clean-ups. The revenues generally come from insurance companies and are used by the Fire Department for materials used in cleaning up spills.

G. For the DPW the Town Meeting votes to approve the use of available funds for the reconstruction and improvement of Town roads which are then reimbursed under the Chapter 90 program of the State. The Town currently receives $824,286 per year.

H. As part of reducing the Town's Health Insurance costs a few years ago, the Town agreed to establish a Healthcare Reimbursement Account and fund it at $200,000 which we've done and now we only replenish the funds used during the previous year. For FY14 the estimated amount is $6,600.

Article 8 - This article is the Capital Improvement Plan for FY14. Annually, the Town puts together a prioritized five-year capital plan based on rating requests from departments for several criteria on a point system. The highest rated requests are funded in the first year with many of the lowest rated requests not being funded at all. One change made on the warrant this year is that we are including the scheduled replacement date for each piece of equipment as included in the Town's Schedule of Depreciated Assets required for our independent audit under the Governmental Accounting Standards Board Standard #34. The items included in this year's proposed capital improvement plan are:

A. To study the DPW Garage Roof at a cost of $15,000. The roof is original to the building and installed in 1980 (33 years old) and has started to leak.

B. Replacement of the DPW F350 Utility Truck at a cost of $57,000. The existing truck was scheduled to be replaced in 2006.

C. Replacement of the DPW Backhoe for the Water and Sewer Departments at a cost of $140,000. The full cost of this acquisition will be paid from the Water and Sewer Fund Retained Earnings and will replace a 1995 Backhoe that was scheduled to be replaced in 2005.

D. Replacement of the DPW Van used by the Sewer Department at a cost of $29,500. The full cost of this acquisition will be paid from the Sewer Fund Retained Earnings and will replace a 1999 Van that was scheduled to be replaced in 2004. The Town is required to inspect approximately 35 pump stations on a regular basis and to undertake regular maintenance on these pump stations. This van is used for this purpose and contains the tools and parts needed.

E. Repairs of several Fire Department vehicles at a cost of $75,000. This portion of the capital plan will be used to repair fire trucks to prolong their life, these include a 1996 Pumper Truck; 1991 Pumper Truck; a 1998 Rescue/Pumper Truck; and repairs to the vehicle used by the Fire Chief.

F. Replacement of the original windows at the Library at a cost of $160,000. These windows are original to the older part of the Library and date to 1908. The windows are single paned glass and the wood sills are rotting.

G. Replacement of three police cruisers at a cost of $106,500. The Town has a regular rotation of police cruisers to keep the fleet reliable.

H. Replacement of outdoor stairs at Fales Elementary School at a cost of $55,000. This would replace a set of stairs at Fales that date to the original construction of the school in 1963 and have settled and cracked leading to a dangerous condition.

I. Replacement of the Mill Pond Gym Floor at a cost of $215,000. The floor is ripped in places and deteriorating. The floor would be replaced with a better surface similar to the existing floor at the Armstrong School.

Article 9 - Town Hall Renovation - This is the same project that came before the Town at last year's Town Meeting. At this time, the Town is looking to phase in the several building projects over the next several years to meet several goals, which include doing all projects within Proposition 2 1/2; keeping the percentage of debt service as a portion of the overall General Fund budget at 7% or less; and keeping the dollar figure of the General Fund debt at less than the FY12 dollar figure. Unfortunately with the economy getting better, the cost estimate on this project has increased from $6.6 million to $7.1 million during the past year.

Article 10 - Forbes Roof Repair - A few years ago the Town Meeting authorized $330,000 to replace the roof at the Forbes Municipal Building, the project was put on hold while the Town was seeking to renovate the entire building. With the phased in approach, the building isn't scheduled to come back before Town Meeting until 2016 but this past Fall during a November Nor'easter a portion of the coping on the roof came off and it was discovered the wood underneath is rotted (which is why during high winds it was ripped off). We are currently working on getting estimates to undertake the repairs with the goal of having a dollar estimate before Town Meeting. These repairs would be in addition to the $330,000 previously approved and the work will be undertaken this Summer and will be consistent with the design plans for a

future renovation.

Article 11 - Installation of High Visibility Crosswalks and Signage - The Bicycle and Pedestrian Ad Hoc Committee submited a warrant article for $20,000 to begin improvements to the highest priority crosswalks in town. The improvements are estimated to cost $1,000 per crosswalk, therefore this article would allow the Town to undertake improvements to the 20 highest priority crosswalks.

Article 12 - Town Water System Improvements - This article seeks to do 3 different things. (1) it seeks to undertake regular maintenance on the water distribution system to reduce issues with dirty water; (2) to replace one of the electric generators; and (3) to review the processes at the water purification plant. The estimated cost for this Article is $390,000.

Article 13 - CSX Mitigation Appropriation - When CSX went through the site plan approval process, they provided $1,000,000 for mitigation for certain items including hazmat training, a foam trailer unit and Pick-Up for the trailer, an electronic height sensor warning system for the E. Main Street bridge, Traffic Signalization for Walkup/Flanders Road, Beaver Removal and Paving Walkup or Painting the E. Main Street Bridge. These funds can be used for these purposes, but require Town Meeting approval beforehand.

Article 14 - Assabet Regional Vocational School Reserve Fund - Seeks to establish an account for compensated absences for employees terminating employment to set aside funds to pay future liabilities of sick and vacation leave.

Article 15 - Youth Commission Membership - This Article seeks to expand the membership of the Youth Commission from 5 members to 9 members with the 4 additional members consisting of 2 seniors and 2 juniors from the high school.

Article 16 - Zoning Bylaw on Medical Marijuana - This Article seeks to ban Medical Marijuana and if that is not accepted by the Attorney General, to limit Medical Marijuana shops to areas within an overlay zone approved by Town Meeting and then by special permit.

Article 17 - Citizen Petition to limit the tax rate increase for FY15 and FY16 to 0% over FY14 (the upcoming fiscal year). The only way to accomplish this is through the votes on the budget not by a separate article, which has been explained to the proponent. Additionally, voters should be sure they understand the difference between an increase in the property taxes raised and the tax rate (i.e. the FY13 tax rate of $18.97 per thousand was a reduction from the FY12 tax rate of $19.21 per thousand of -1.25%).

Posted 12-21-12

Where can I find information on the Town's Budget and Capital Plan?

Answer: On the Town Manager's page, there are links to The Budget Message, Budget Summary, Five Year Financial Forecast, Detailed Budget information, Capital Plan and Road Management System. The page can be found here.

Posted 12-14-12

Who's responsibility is it to shovel and sand sidewalks in Town?

Answer: The Town has no bylaw requiring abutting property owners to shovel or sand sidewalks in front of their property. The Town Meeting voted down such a bylaw a few years ago. The Town plows some sidewalks around town which on main streets to provide a safe place to walk, but the Town doesn't have the staff or funding to plow all 41 miles of sidewalks that exist in Town.

Posted 9-10-12

Question: What are we going to vote on at the Fall Town Meeting?

Answer: There are 26 Articles on the draft warrant summarized as follows:

1. At the request of the Moderator, we've included an article that would provide for opening statements from the Chair of the Finance Committee and Town Manager on the state of the Town's finances.

2. An article to approve a debt authorization within Proposition 2 1/2 for the construction of a new fire station at $11.8 million.

3. An article to reduce the debt service budgets of the Town by approximately $1,361,000 due to refinancing and some debt on the wastewater treatment plant not hitting until FY14.

4. Use of insurance proceeds over $20,000 for a police cruiser that was hit and totalled.

5. A request to fund $4,000 for the Police Department for a contract with UMASS for Emergency Medical Dispatching.

6. A request to fund $20,000 to assist the Board of Assessors in both the revaluation and new permits.

7. A request to fund $50,000 in repairs to the Forbes Municipal Building, mostly related to the recent inspection failure on the building elevator and to repair some a/c and heating units.

8. A request to increase the Chapter 90 authorized spending since the Transportation Bond Bill included an additional $12,000 for Westborough than anticipated.

9. A request to create a School Department Revolving Fund to be used for homeless student transportation expenses with revenues coming from the State.

10. A request to replace the Fisher Street Water Plant's roof at a cost of $495,000. This would be paid through the Water Fund's Retained Earnings.

11. A request to replace the Flanders Road Sewer Line at a cost of $800,000, which has experienced several breaks in the past few years and has deteriorated. This will be repaid by sewer users and the Town of Hopkinton.

12.A request to increase the debt authorization on the Crownridge Sewer Project from $2.2 million to $2.7 million due to the need to include an additional pump station for the project to move forward.

13. A request to replace pumps in the water system. The funding would come from prior articles to replace other pumps that are now a lower priority than requested in this article.

14. A request to amend the General Bylaws to allow bow hunting during deer season.

15. A requst to amend the General Bylaws to reduce the Town's liability for fixtures installed in basements below the grade of the sewer line in the street.

16. A request to amend the General Bylaws for sign violation enforcement to be done through Non-Criminal Disposition.

17. A request to amend the General Bylaws to change the dates dog licenses are due to consolidate the annual census and dog licensing and to have the dates coincide.

18. A request to amend the Zoning Bylaws to regulate the placement of ground-mounted solar photovoltaic installations.

19. A request to accept MGL Ch. 59, Sec. 8A - Veteran's Tax Work Off Program (also known as the Valor Act) to provide a program where veterans can work off part of their property tax by working for the Town.

20. A request to amend the Veteran's Freedom Park Deed Restriction to allow a fitness trail system to be installed and a bandstand.

21. A request to amend the Town Charter to remove two Committee that have previously been eliminated.

22. A request to abandon a portion of Summer Street and accept another parcel in the same area to allow for the owners of the Arcade building to renovate the building on the Town Rotary and construct a handicapped access ramp, new sidewalks, granite curbing and improved parking.

23. A request to provide an easement over town property (the Fisher Street Water Treatment Plant) for Toll Brothers as part of the construction of the Transit Oriented Development near the MBTA Station.

24. A request for an additional liquor license at Bangkok Thai Restaurant.

25. A request for an additional liquor license at Bay State Commons.

26. A request for a Home Rule Petition to allow Westborough Town Meeting to vote on the statutes that exempt a Town from the liquor license quota system (these statutes are still in MA General Laws, but had a sunset provision requiring local adoption before 1985).

Posted 8-2-12

Question: On the upcoming Special Town Meeting, I have the following two questions:

1. What is the actual revenue the town is forgoing?

2. What is the expected increase in business income to local businesses expected from increased employees of the companies in the town, due to the expansion of Dana Films and the new MicroChem facility?

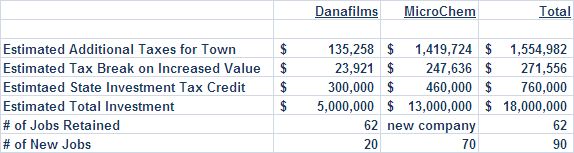

Answer: The first question is an estimate based on the investments the two companies are making and is estimated to be approximately $288,000. However, this has to be balanced with the additional tax dollars the town will receive based on the investements both companies are making and is estimated to be $1,648,830 or about 6 times the value of the revenues the town is foregoing. The companies will also be receiving approximately $860,000 in investment tax credits from the state.

The second question is impossible to answer, but there will be 83 additional employees shopping, eating, buying gas, etc and any business the companies do wtih local businesses.

Click here for the Town Manager's Presentation that will be made at Town Meeting

Posted 7-27-12

Question: Why did the Board of Selectmen set a Special Town Meeting in August? Couldn't this wait until the Fall Town Meeting in October?

Answer: The Board of Selectmen has scheduled a Special Town Meeting for consideration of granting two Tax Increment Financing Agreements (TIF) to two companies. These are the only two items that will appear on the Town Meeting warrant.

The reason the Town Meeting is scheduled on August 7, 2012 (at 7 PM at the High School) is that it provides the time necessary to get on the agenda for the Economic Assistance Coordinating Council (EACC) agenda for September. The EACC reviews each TIF and approves of the TIF and the State’s Investment Tax Credit at their meetings. If the Town waited until the October Fall Town Meeting, the next EACC meeting would either be at the end of December or early January which would put any incentive off for six months. In order to compete with other states and other communities in MA, especially cities that can grant TIF approvals every other week when their city council meets, the Town scheduled the Special Town Meeting at the earliest date possible.

The most important part of these types of TIF agreements is for taxpayers to understand that the “tax break” that is being offered is only on the increased or incremental value from the company’s investment in their property and that the Town will collect more tax revenues after the TIF than before. For example, if a company buys a building that has a current base value of $5,000,000 and expands the business and after the expansion the property is valued at $7,500,000 the TIF is applied to the difference (or $2,500,000). There is never any break on the base value, so the Town always collects at least the amount it was collecting before the TIF.

In this case, both TIFs are very similar and offer a 15 year incentive on any increase in property value that reduces the taxes on that increased property value by the following percentages:

Year 1 50% (on the incremental increase in value)

Year 2 40%

Year 3 30%

Year 4 20%

Year 5 10%

Years 6 – 15 continue the 10% incentive.

Of the two companies that the Town has offered a TIF, the following is a breakdown of the benefits to the company, expected job growth and benefits to the Town:

The first company is Danafilms, which is presently located at 5 Otis Street and manufactures plastic and plastic sheeting. They are looking to expand their line and add an agricultural plastic sheeting product used in baling hay. The parent company owns the business here in Westborough and another plant in Kentucky and is trying to make a decision on where to locate this new line. The company is planning on adding 20 jobs to the existing 62 jobs here in Westborough. The estimated tax benefit to the company under the TIF is between $13,500 and $34,500 over the 15 year life of the TIF (we use a range because it’s difficult to determine how much of their investment will be reflected in increased assessed value for tax purposes). The additional taxes the Town is estimated to collect should the company

expand in Westborough is between $77,226 and $193,066. The State Investment Tax Credit is estimated to be approximately $300,000.

The second company is MicroChem, which is presently located in Newton, MA and manufactures specialty chemicals for the electronics industry. They have outgrown their current location and do not have the ability to expand. They are looking to relocate in Massachusetts and are looking at purchasing the property at 200 Flanders Road in an industrial area. The company currently employs 47 people in Newton and would add another 23 jobs if they relocate to Westborough for a total of 70 new jobs in Westborough. The estimated tax benefit to the company under the TIF is between $232,000 and $264,000 over the 15 year life of the TIF. The additional taxes the Town is estimated to collect if the company relocates to Westborough is between $1,329,103 and $1,510,000. The State Investment Tax Credit is estimated

to be approximately $500,000.

In summary, the two companies would create 90 new jobs and retain 62 existing jobs, generate over $1.5 million in estimated new taxes over the next 15 years in exchange for providing an incentive valued at approximately $272,000 during the same 15 year period and a state investment tax credit (does not involve the Town) of $760,000. If at any time, either company did not meet their employment goals, at the Town’s discretion, the tax incentive could be terminated.

Posted 7-20-12

Question: Has changing our Town Meeting date to March made it more difficult to accurately predict state aid and how will this affect our budget?

Answer: The Town starts its budget process now in the late Fall and I'm required to submit budgets to the Selectmen and Finance Committee by the end of December. I tend to use conservative estimates and the Governor releases his budget at the end of January so we have an idea what state aid figures might be. This past budget year in December I estimated net state aid to be $5,038,000 and by the March Town Meeting had increased this estimate to $5,154,000. The final state aid figure was $5,317,000 or about $163,000 more than we anticipated at the time of Town Meeting. Overall state aid ended up being approximately 3% higher than anticipated at the time of Town Meeting, this difference will be used toward lowering the tax rate when it's actually set later this year. It's important to note

that state aid at $5.3 million only accounts for 6.8% of the Town's $78.2 million budgeted revenues.

Posted 5-15-12

This wasn’t really a question but a response to some comments posted to news stories about the fire station debt exclusion vote and another asking residents "what is a fair tax rate". Some of the questions made me think about the Town’s finances since I began in 2009 (FY10) and where the increases and decreases have been and whether the Town has been responsive to the economic conditions and concerned about the impact on taxpayers.

Answer: The table below shows FY10 (2009/10) through FY13 (2012/13) and where the increases have been and offsetting decreases in the Town’s budget.

Looking at this table, there obviously needs some additional explanation, but my general comments on the Town’s finances during this period are as follows:

- The Town’s Insurance costs are less in the FY13 budget than the FY10 budget due to the changes the Town has made to the health insurance benefits for employees. This budget is $794,332 or 7.2% less than it was four years ago.

- The areas that the Town has invested most have been the Council on Aging, Veteran’s Services, Fire/EMS, Recreation, Youth Commission, the Building Department, the Library, Public Works and Police.

- Other areas where there have been increases that warrant further explanation are:

- School Department - The Westborough School Department Budget has increased $3,027,381 (7.9%). The Assabet Regional Vocational School Budget has decreased by $89,122 (-11.5%) due to a reduction in enrollment at Assabet from 53 to 44 students.

- Street Lights – The Town hasn’t added 56% more streetlights, the increase is due to a large increase in the electric rate that was signed on a five year contract the year before I started. FY13 is the last year of that contract and I believe we will see a significant decrease (at least SIX figures) in FY14 for all of the departments that pay electricity.

- Elections – This is just a cyclical issue (where the budget goes up and down based on the number and type of elections) and FY13 is a “high” year because of the Presidential Election this fall.

- Council on Aging - The Town has increased the hours for both the Outreach Worker and Homemaker to meet the demand for these services.

- MIS/GIS – The increase in this budget essentially stems from software the Town’s Fire Department was mandated to use for EMS to manage patient care (the ongoing software maintenance costs are in the MIS budget), the electronically permitting software for the Building Department and that the Town put together a plan to regularly replace computer equipment on a five-year plan.

- The Health Department increase is due to moving the Mosquito Control and Household Hazardous Waste Day out of the Regularly Recurring Article on the Town Meeting warrant and moving it into the Health Department Budget.

- The Debt Service budget was the largest increase and this was due to projects that were approved by Town Meeting in the mid 2000’s including purchasing the V-Arc property, the Senior Center Roof, various road projects including the Robin Road area and Wheeler/Oldham Road area with debt first hitting the budget in FY12.

- The DPW in FY13 was increased to replace the second mechanic position that was left vacant for the past 4 years.

- The Fire Department was increased in FY11 to replace the Firefighter/EMT position that was left vacant for several years to ensure adequate staffing.

Do I believe the Town Departments, Selectmen and Finance Committee have been responsive to the economic conditions and done their very best to maintain services while keeping the Town's budget increases to a bare minimum? Absolutely!

I'll also note that if you click here on the Budget Message for FY13 starting on page 4 there is a list of additional services various town departments are providing and/or ways they have cut costs during the past year to help maintain services to the public. It's an impressive list of improvements given the minimal increase in the budget over the past several years. When considering various requests over the next few years I'd ask voters to keep these efforts in mind.

Posted 5-9-12

Question: Why did our tax rate go up from $18.24 in Fiscal Year 2011 to $19.21 in Fiscal Year 2012?

Answer: In summary, there are five major reasons the tax rate increased $0.97 in the last year. The first reason is that the assessed value of the Town went down by $58.2 million which accounted for $0.35 of the increase. The remaining increase was related to the following increased spending - Town Department Budgets (not including Insurance and General Fund Debt) - $0.04; Insurance - $0.22; General Fund Debt - $0.18; and Schools $0.20. Added together these major categories add up to the $0.97 increase in the tax rate.

Posted 5-3-12

Question: How will the Fire Station project be financed (e.g. muni bonds), term and interest rate? What is the projected incremental basis point impact on the tax rate over the next ten years?

Answer: The Town would be issuing standard municipal bonds. We are estimating 3.5% for the interest rate for a 20 year term. The following table shows the estimated debt service (principal and interest) and impact on the average single family home in Westborough:

Posted 5-2-12

Question: Does the Town have to tax to the max every year? Where do we stand?

Answer: It depends on many different factors, however over the past several years based on the economy the Town has attempted to maintain costs among it's departments and has taken action to reduce health insurance costs 2 out of the last 3 years. An example of how this impacts the Town's finances is that the Town was approximately $10,000 from taxing to the maximum amount allowed under Proposition 2 1/2 in FY09 (levy limit) and there were concerns that the Town would need an operating override to maintain services. During the past few years the Town has not taxed to the max but has tax only the amount needed to cover level services in the budget. The following chart shows a ten year history (FY03 to FY13). In FY13 it's estimated that the Town will be approximately $2.5 million under it's levy limit (compared

to the $10,000 figure in FY09) demonstrating that Town budgets have not been growing at the level allowed under Proposition 2 1/2.

Posted 4-26-12

Question: Earlier this week, there were people handing out bright pink flyers at the Senior Center asking voters to vote against the Fire Station project. The flyer included some information that concerned me, can you respond to the information presented in that flyer?

Question 1: Why has the fire department not moved out if it’s in such dangerous condition?

Answer: There’s no place to go, what building in town would you move all of the fire apparatus, ambulances and equipment and have offices space, communications center and space for the equipment that is centrally located in Town? The building has been determined by professional structural engineers to not be structurally sound and impractical (cost-wise) to renovate to bring it into compliance with the current building code.

Question 2: Why was the Police Department the only department able to reduce its budget by 2%?

Answer: The following department reduced their Fiscal Year 2013 budgets by the following amounts for a variety of reasons:

(the Police Dept budget did not decrease by 2%)

The Town Insurance line item is the largest line item next to the School Department and this is the second time in the past three years that the line item has been decreased and the FY13 budget is less than the FY10 by over $400,000.

Question 3: When will the Town be forced to fund the pensions for Town employees in the amount of approximately $80 million?

Answer: The Town is on a funding plan to have a fully funded pension program through Worcester Regional Retirement System by or before the deadline in FY2040. We contribute every year to the program, so there will be no “surprise” $80 million bill taxpayers will be faced with.

In fact, public employees in Massachusetts are not eligible for Social Security, this means the Town does not pay into the Social Security System the 6.2% of total salaries that are paid by private employers and public employers in other states. Because of this, in Fiscal Year 2013, the current retirement program costs taxpayers $445,460 (highlighted in yellow below) less for taxpayers than paying into Social Security!

The following table shows the savings between the current retirement system and what Social Security would cost:

Posted 4-24-12

Question: The Debt Exclusion Vote on the Fire Station is very confusing. What does a yes vote or no vote mean and is it the same as an override?

Answer: A debt exclusion vote is worded very specifically by state law. Massachusetts General Laws, Chapter 59, Section 21C dictates the exact wording that has to be included in a debt exclusion vote. In the case of the Fire Station, the wording is, "Shall the Town of Westborough be allowed to exempt from the provisions of proposition two and one-half, so-called, the amounts required to pay for the bonds to be issued in order to construct a new Fire Station?"

A yes vote means that you agree to exempt the debt payments from the Town's annual Proposition 2 1/2 levy limit and a no vote means that you do not agree to exempt the debt payments from the Proposition 2 1/2 levy limit. A yes vote means the Fire Station project will move forward, a no vote would require the project to go back to Town Meeting for reconsideration since the vote at the Annual Town Meeting required the debt to be excluded from Proposition 2 1/2.

A debt exclusion vote is different from an override vote because it is temporary and only exempts the amount of the debt payment from Proposition 2 1/2 and as the debt is paid off the "debt exclusion" is reduced each year. An override is a permanent override of Proposition 2 1/2 by a set dollar amount.

The following link is an excellent Primer on Proposition 2 1/2 put together by the Massachusetts Department of Revenue Proposition 2 1/2 Primer

Posted 3-30-12

Question: At the Town Meeting, there were a lot of comments about the local economy, including comments that Westborough had the 9th highest tax rate in the State and that there were 33 foreclosures last year. How does the Town stand? Also, what is the Town doing about the fact that the commercial tax base used to be 60% with the residential tax base being 40% and the recent swing that now the commercial tax base is 40% and the residential tax base 60%?

Answer: The answer is that the economy has improved both nationally and locally. Tax rate is not as important as the average single family tax bill (which Westborough is 32nd statewide and has been for some time). The following charts and tables helps explain how the Town/Region stands economically:

This first table shows the Gross Domestic Product (GDP) for the United States in trillions of dollars which refers to the market value of all goods and services produced within the country in each of the years listed below and while there was a dip in 2008/2009 there has been a rebound in 2010, which the following tables help show how this is reflected regionally and locally. (Source: World Bank)

While GDP shows what is going on nationally, GDP Per Capita is generally considered a way to measure the standard of living within a country, the following table shows the GDP Per Capita in the United States. Again, there is a dip in 2008 & 2009 but the 2010 level is the highest standard of living. (Source: World Bank)

While the above chart shows how we are doing nationally, the chart below shows how each state is doing. Massachusetts is one of 11 states leading the nation with 4.2% economic growth in the last year measured (source: US Dept of Commerce, Bureau of Economic Analysis)

Even closer to home, the following table shows a 10-year history of the unemployment rate in the Framingham "New England City and Town Area", which is the closest area in our region to Westborough. This chart shows that the current local unemployment rate of 4.8% has dipped below the 2002 level of 4.9%. (Source: US Dept of Labor Statistics)

The 495/Metrowest Compact Region is an important job center providing 400,000 jobs or 11% of the total employment in the state. Notably almost 25% (100,000) of these jobs are located in the City of Worcester.

The Route 9 Corridor east of Worcester, including Natick, Framingham, Westborough Shrewsbury and Southborough collectively provides another 52% (208,000) of the Region’s employment. (Source: 495/Metrowest Compact Plan released 3/19/12 by MA Dept of Housing and Economic Development)

In the past 18 months, over 2,400 new jobs were created in Westborough and over 1,300 jobs were retained, the following is a list of companies that have either moved to Westborough or expanded (Source: Westborough Economic Development Committee):

- BJs Corporate Headquarters – 1,200 new jobs

- BNY Mellon – 900 retained jobs, 200 new jobs

- eClinical Works – 400 retained jobs, 200 new jobs

- Coughlin Electric – 60 new jobs

- CSI – 50 new jobs

- Courion – 100 new jobs

- A123 – 250 new jobs

- Travelers Insurance – 300 new jobs

- Ameridose – 250 new jobs

Home prices in Westborough have stabilized according to redfin.com, a MLS website that includes statistics on sales in each community. The following table shows that the average list price of a home in February 2012 was $462,000 up 2.8% from January 2012 and up 10.1% from February 2011. It also shows that homes that sold in February 2012 were sold at 96.5% of the asking price which was also up from January 2012 (2.6%) and up from February 2011 (2.8%).

What about the 9th highest tax rate, how can Westborough be that high and what does it mean?

It doesn’t tell you much unless coupled with the value of the average single family home. Consider the following (Source: MA Dept of Local Services Municipal Databank):

While Westborough has a higher "tax rate" Weston has a much greater Average Single Family Tax Bill due to the values of homes. Tax Rates are only a mathematical equation dividing total assessed value by the amount of property taxes raised. Without the value in the equation comparing tax rates doesn't mean very much as the example above shows.

Average Single Family Tax Bill is a much better comparison since it shows what the average homeowner actually pays. Westborough currently rates 32nd in the state in highest Average Single Family Tax Bill and has been at that point (+/-) since 2003 when the expanded high school and Mill Pond School opened. Before that going back as far as the State website has records, the Town was between 34th and 77th highest in the state. From 1988 through 2002 Westborough was in the top 15.5% in highest average single family tax bills and since 2003 Westborough has been in the top 10.1%.

While this isn't a great statistic, it shows that for a long time Westborough has had fairly high property taxes relative to all other communities in Massachusetts. The problem with this statistic is that it compares Westborough to many communities that are not similar to Westborough, including small towns of 400 people in the Berkshires and Cities that receive a lot of state aid such as Lawrence. A more accurate comparison is to compare Westborough to the other communities in what is referred to as the "495 Metrowest Area", which includes the following communities (Source: Department of Local Services Municipal Databank):

The table above sorts these 31 communities from the highest average single family tax rate to the lowest and shows that Westborough is in the middle of the communities in the 495/Metrowest area. The column in "yellow" shows communities that receive more state aid than Westborough and demonstrates the impact of state tax policy on local property taxes. The columns highlighted in "orange" shows communities with a split tax rate which also demonstrates the role that local tax policy can play on property taxes. Among these communities Westborough is 11 out of 31 just outside of the top 1/3. However, if Westborough were to receive the average state aid of these communities and split it's tax rate so that businesses paid the average split commercial rate, Westborough would drop to 16 of 31 or

just into the bottom half.

The following table shows the breakdown between Residential (Single and Multi Family) and Business (Commercial, Industrial and Personal Property) as far back as the State's website contains data (Source: Department of Local Services Municipal Databank). This table shows the Business "high" of 52.9% in 1987 and that since 1995 that residential property has ranged right about where it is now at 62.6%. Residential peaked in 1998 at 63.0%.

Were there really 33 foreclosures last year as stated at Town Meeting? No, the following chart shows the number of foreclosures over the past 20 years. While there was a spike in 2007-2010, it was nowhere near as bad as the period 1991-1995 and the recent numbers dropped off significantly in 2011 with only 5 single family foreclosures and 1 condo foreclosure and further in the first quarter of 2012 with just 1 condo foreclosure (source: Westborough Board of Assessors).

What are some of the things the Town is doing to help encourage business to improve the tax base and create jobs?

- Established the Economic Development Committee to coordinate the Town’s efforts.

- Proactively engaging existing companies, businesses and brokers on economic development issues.

- Changed zoning to allow greater density and height while adding environmental protections.

- Become designated an Economic Target Area and a Platinum level bio-ready community to attract med-tech companies.

- Engaging in an Economic Development Self Assessment through the Dukakis Center at Northeastern (1 of 3 communities to be asked to participate)

Posted 2-14-12

Question: The 60/40 Question - I keep hearing that at one time businesses contributed 60% of our tax base and residents 40% and that now this is reversed. Is this true and if so, why the big change and what are we doing to reverse it?

Answer: The answer is that it is cyclical and fluctuates from year to year. Since, 1985, when information is available, the high point was in 1998 when residential values hit 63.0% of the total valuation of the Town and the low point was in 1987 when residential values dropped to 47.1% so there isn't a time in the past where records indicate it was as low as 40%. Since 1998 the Residential vs. Business portion of the values in Town have been relatively stable with the residential portion varying from 59.0% to 63.0%. In 2012 the residential portion of the town's valuation for tax purposes was 0.4% less than in 1998. The changes are due to many factors one of which is that during the period from 1985 to 2012 there has been a 38% increase in the number of residential units in town. Commercial property is

valued differently than residential property where as there are vacancies and rents drop to attract new tenants, the value of the property drops due to the overall decrease in the income potential for the property (due to lower rents). Residential property is valued on comparable market sales. This increase in the number of residential units combined with commercial real estate market values dropping are the main reasons why residential property has increased as a proportion of overall value in town. The chart below shows the variations in Business (Commercial + Industrial) values vs. Residential as a percentage of overall town value from 1985 to present: